2023 Junk fees report: impact on the American consumer

In the 2023 State of the Union address, President Biden announced the Junk Fee Prevention Act, aimed at tackling the excessive add-on charges—called "junk fees" by the administration (1)— that plague the everyday purchases of the average American. We’ve seen the headlines surrounding excess or predatory pricing fees (the Taylor Swift Ticketmaster fiasco comes to mind, or Wells Fargo's settlement for illegal fees). Junk fees are prevalent in every industry. Corporations made billions of dollars in revenue from junk fees in recent years, with the banking and credit card industries alone making over $29 billion (2).

We surveyed a sample of American consumers (see full methodology) to gauge how the general population feels about junk fees, how junk fee practices affect the average person's purchasing habits, and who Americans think is responsible for addressing the junk fee situation.

Key findings:

- 80% of respondents lack trust in companies' ability to be honest and transparent with pricing practices.

- 64% of respondents refuse to purchase a service or product if a junk fee is included.

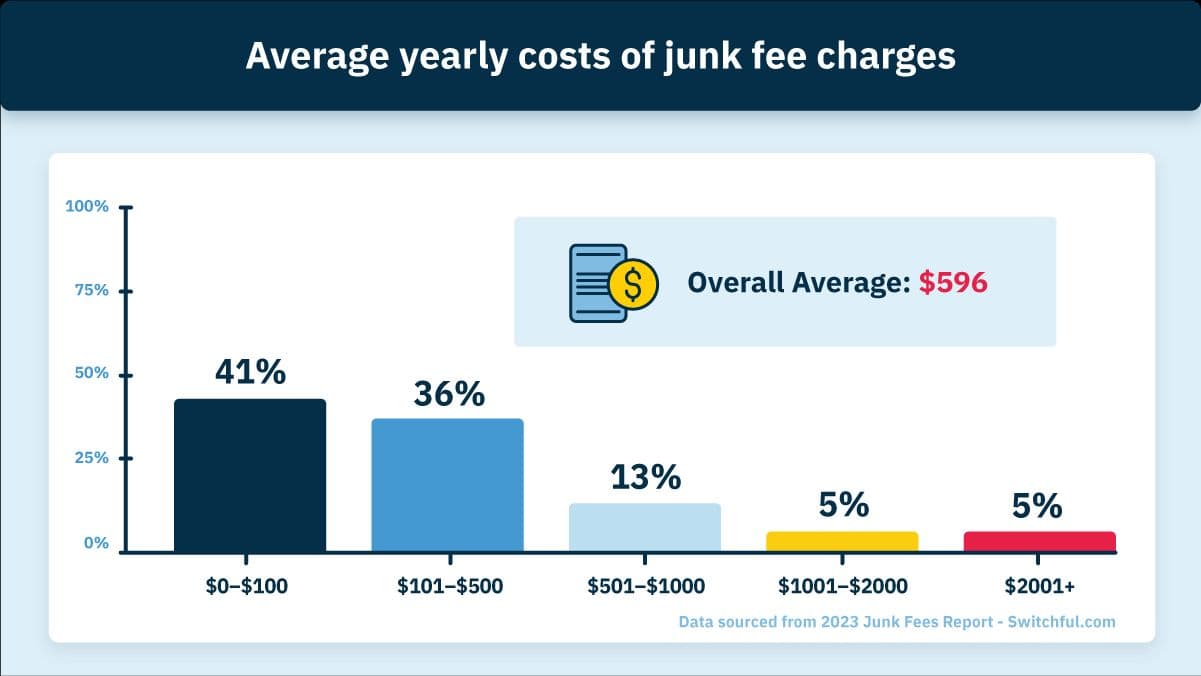

- $596 is the average cost a consumer pays in junk fees per year.

- 44% of respondents lack confidence in the government's ability to make a change.

- Businesses and companies ranked first as most responsible for addressing junk fees.

Junk fees' impact on the American consumer's wallet

With the increase in inflation, many households are tracking their expenses more closely and are more aware of the cost of junk fees than ever. According to our survey, junk fees cost the average American an estimated $596 per year, with some consumers paying upwards of $1,000+ per year. On a national level, that would add up to over $190 billion taken out of American wallets annually.

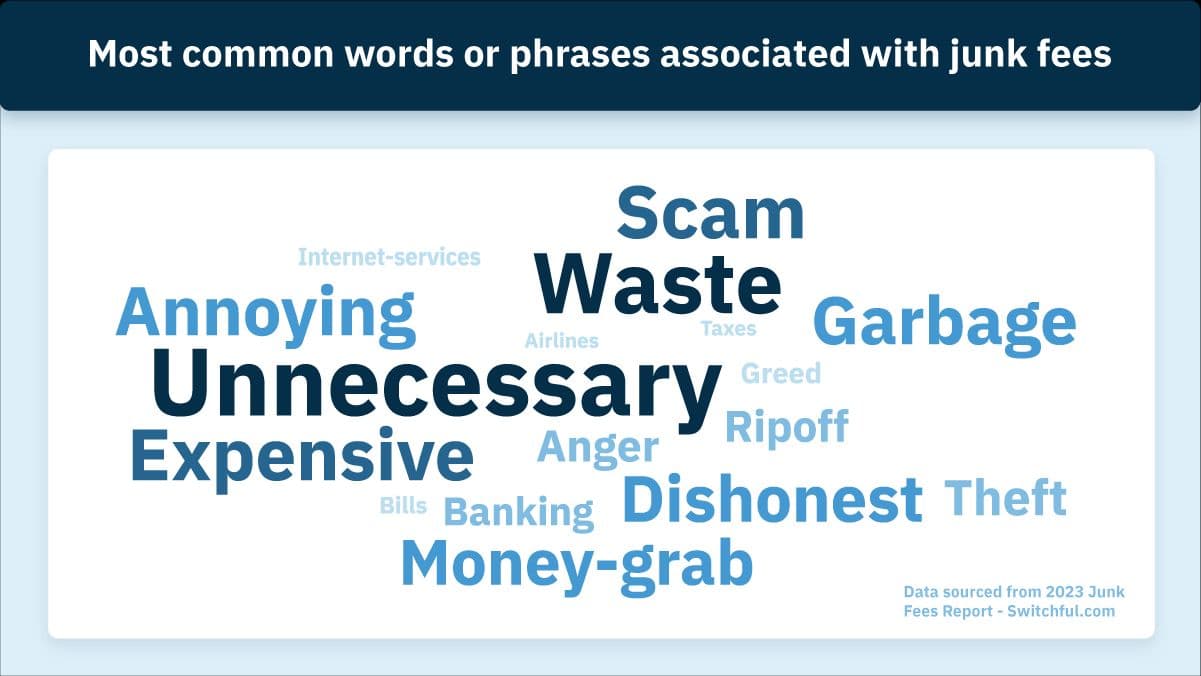

We asked respondents what one word or phrase came to their mind when asked about junk fees. The top 5 responses are:

- Unnecessary

- Waste of money

- Scam

- Trashy

- Expensive

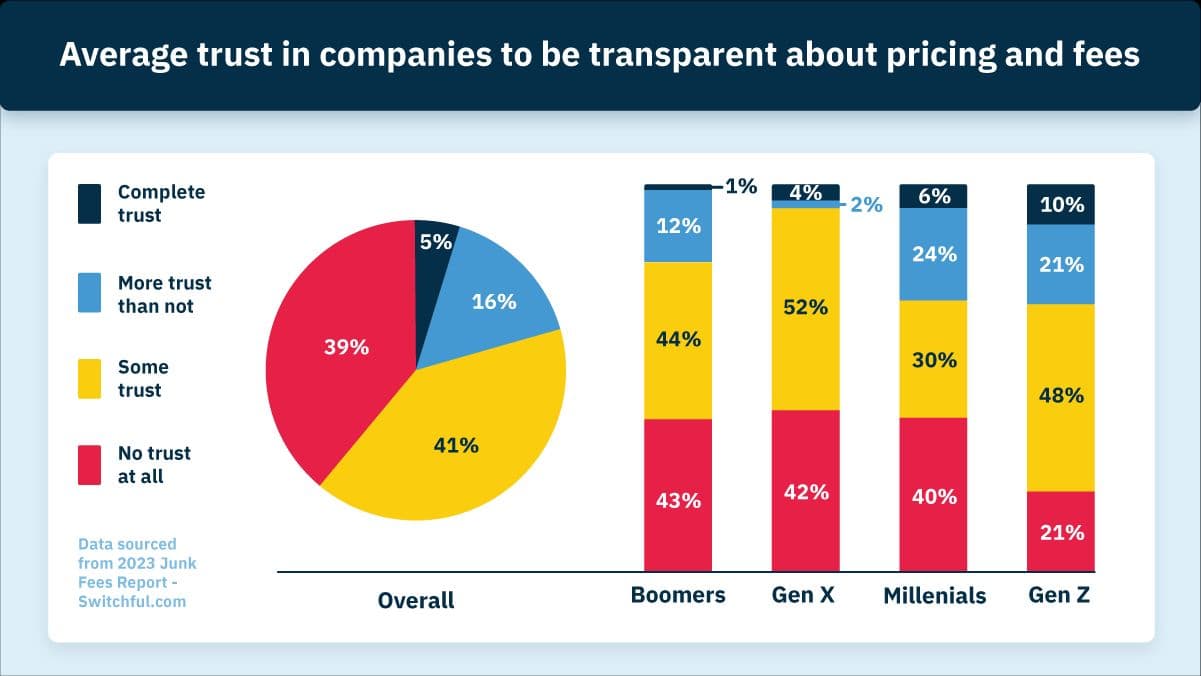

Do consumers trust companies?

The predatory pricing and practices behind junk fees bring pain to more than just wallets. The intense emotions towards junk fees correlate with a decline in the American consumer's trust in companies and businesses. Here's what we found when we asked respondents to gauge their trust in companies' pricing transparency.

- 80% of American consumers lack trust in brands.

- 41% of Boomers and Millennials have no trust at all in companies.

- Only 1 in 20 respondents completely trust companies to be transparent in pricing practices.

"Junk fees are predatory. While a single hidden fee might not seem like a big deal, they often compound if you don't have immediate means to cover them,” says Vilja Johnson, VP of Content and Editor-in-Chief for Switchful. “They especially impact those who don't have funds for surprise costs and consumers with limited options when considering products and services."

Effect of junk fees on American shopping habits

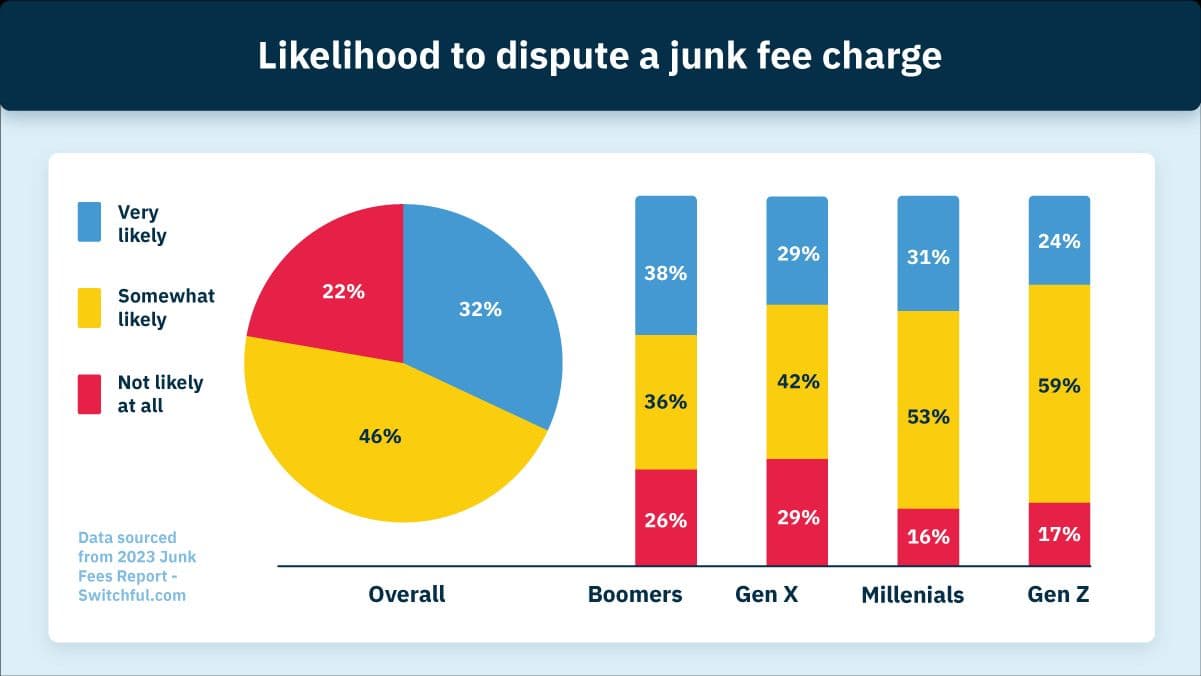

Junk fees are so frustrating that many people (64%, to be exact) refuse to purchase services or products when made aware of extra charges. Additionally, roughly 3 out of 4 consumers are somewhat or very likely to dispute a junk fee. However, this changes across generations, with Boomers being the most likely to fight a junk fee and be successful in the dispute.

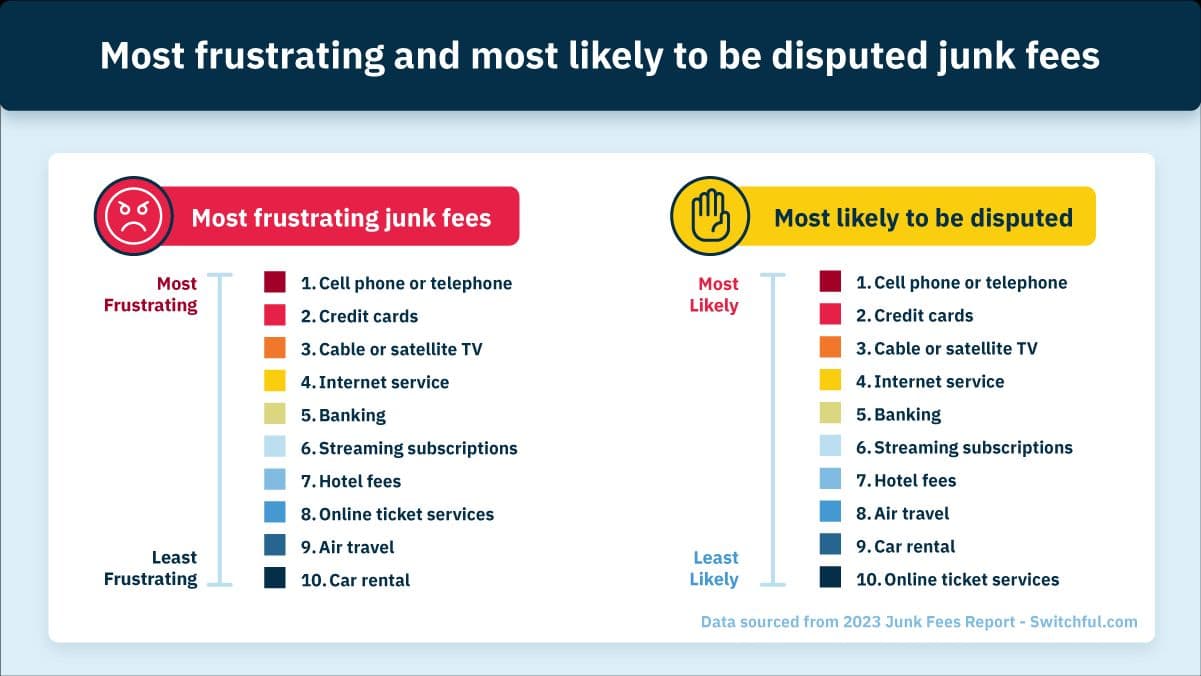

Out of all the industries where consumers notice junk fee practices, the most frustrating are cell phone or telephone services, credit cards, cable or satellite TV services, and internet providers. As these services are used daily, it's no wonder that they reach the top of the list. Other frustrating categories also include banking, streaming services, and hotels.

How do consumers react to junk fees?

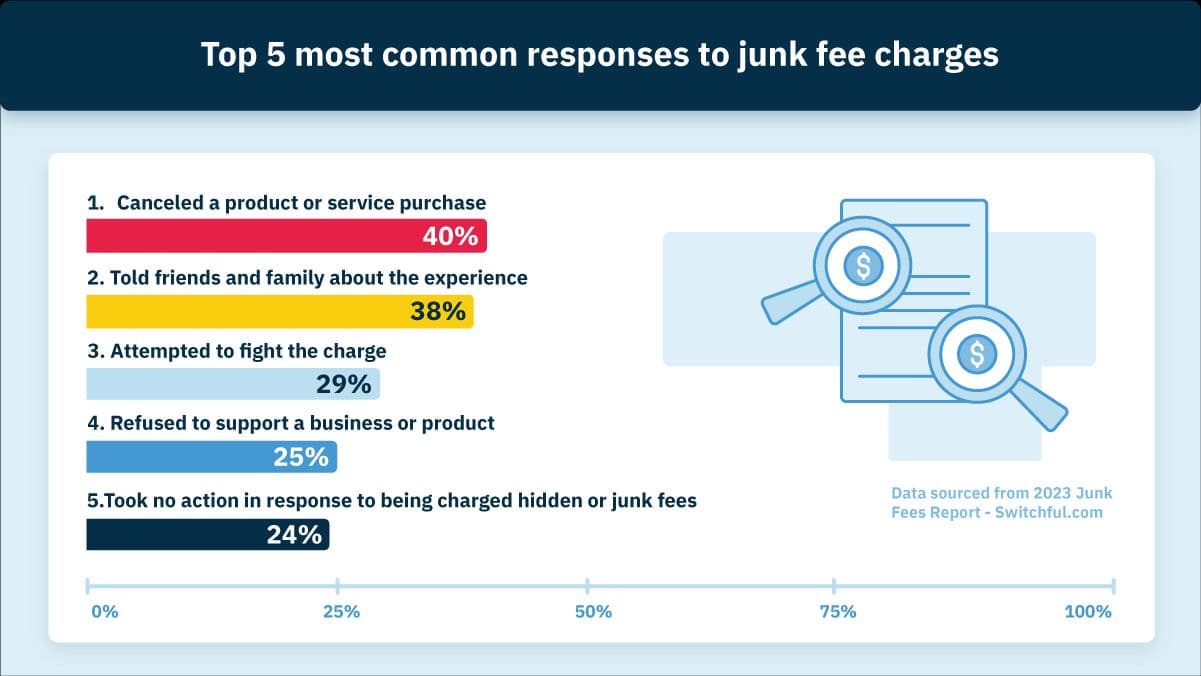

While companies use junk fees to turn a profit, they should think about how the practice can affect them in the long run. In addition to not purchasing a service or product, 78% of respondents said they wouldn't recommend a product or service to their friends and family if the cost included a junk fee. Some of the most common reactions to junk fees are:

- Canceled a service or product

- Told friends and family about the experience

- Attempted to fight the charge

- Refused to support a business or product

- Intentionally purchased with a competitor business

- Submitted a complaint

- Left a poor review on Google, Yelp, etc.

After canceling a service or product, the next most common action taken in response to being charged a junk fee is telling friends and family about the experience. Junk fees don't only decrease brand loyalty—the practice turns current and new consumers into anti-brand advocates.

Who’s responsible for leading the charge?

With the public's perception and the current administration's initiative, it's obvious that junk fees are at the forefront of many consumers' minds and wallets. But how can we tackle these predatory practices effectively? And who is responsible for leading the charge?

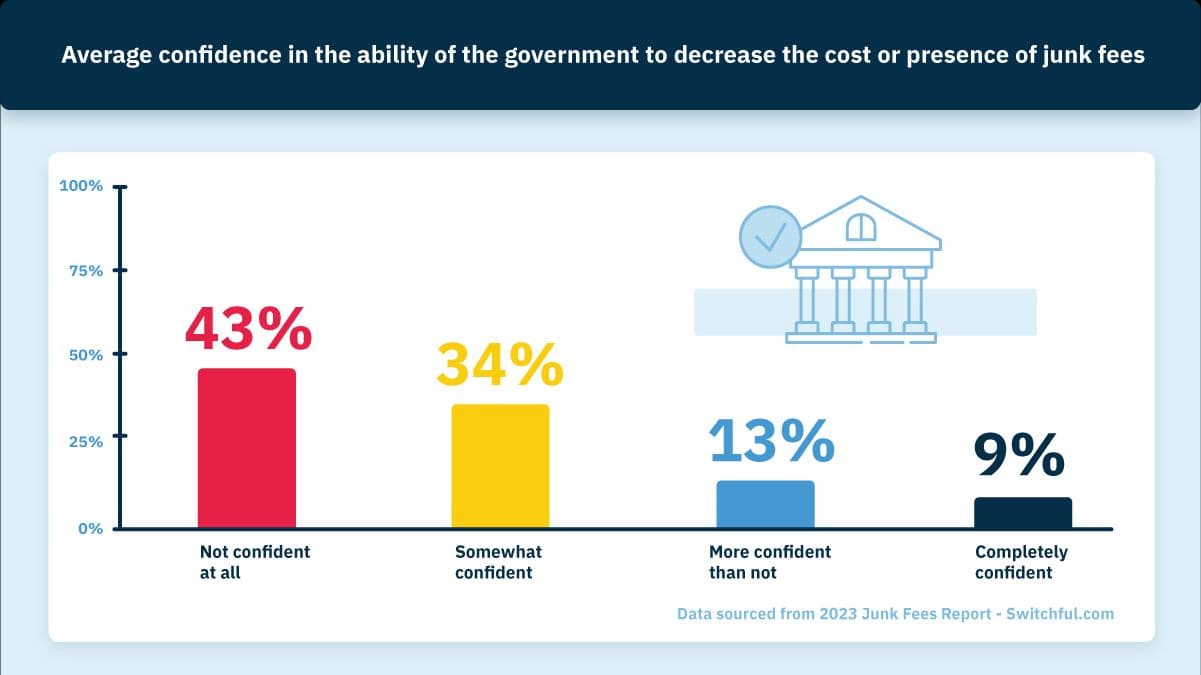

Despite support for actions taken to curb junk fees, only 9% of respondents expressed a high level of confidence in the government to make an effective change. 44% said they had no confidence at all. This sentiment spreads evenly across liberal, conservative, and moderate samples.

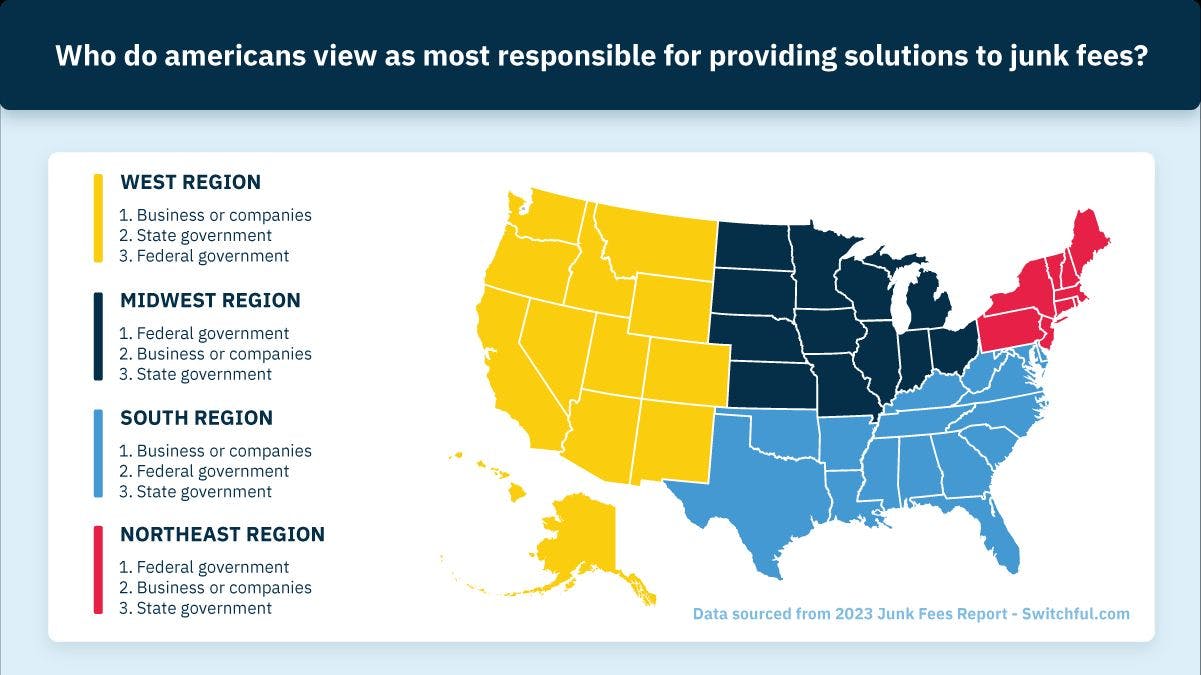

We asked respondents to rank who they thought was most responsible for addressing the situation. Businesses and companies ranked first, with the federal government ranked second, consumers coming next, and state governments ranking last. When divided by age, this response remained largely unchanged. However, depending on what part of the United States respondents lived in, the top three spots alternated between businesses and companies, the federal government, and state government. Consumers were listed last when divided by region.

Influence of the American consumer

According to our survey, junk fees are significantly impacting the spending habits of American consumers, breaking down trust in product and service providers and stretching what are already thin budgets for many. A breaking point might be near—over 50% of consumers report being angry or frustrated with the practice. And with American consumers still expecting businesses and companies to take the initiative to change, there's a possibility that trust can be rebuilt if businesses take the proper actions to curb junk fees.

2023 methodology

Switchful surveyed 250 American adults 18 years old and above to understand their sentiment towards junk fees. We asked respondents about their perspective on junk fees, how they respond to junk fees, and what solutions they would like implemented to address the practice. Results from the survey are representative of a sample of American consumers. Some statistics have been rounded to the nearest whole number for the sake of simplicity. Access the raw data here.

Erin Kratzer is a consumer data journalist and holds a bachelor’s degree in public relations and strategic communications. She considers herself a jack-of-all-trades when it comes to marketing and communications, with her most notable work being business and consumer behavior research for Utah national and state parks. She believes good data journalism is the key to understanding the wants and needs of consumers.

Vilja Johnson leads Switchful's editorial and creative teams. She has been editing content in the consumer tech space since 2016, and she has over a decade of experience teaching writing and editing. She's passionate about creating content that resonates with people and helps them solve real, day-to-day problems. In her free time, Vilja serves on the board of directors for the PrisonEd Foundation, where she runs a writing program for inmates in Utah prisons and jails.

Endnotes and sources

- Remarks of President Joe Biden – State of the Union Address as Prepared for Delivery, White House Briefing Room. Accessed 11 February 2023.

- Consumer Financial Protection Bureau Launches Initiative to Save Americans Billions in Junk Fees, Consumer Financial Protection Bureau. Accessed 11 February 2023.